05.04.2024

The ATIBT and CIRAD have co-signed a publication written by Alain Karsenty on bonus-malus mechanisms.

Alain Karsenty, CIRAD, March 2024

There is a need to clarify the distinction between revenue-generating taxation earmarked for environmental actions and environmental (or ecological) taxation proper. A harmonised definition of environmental taxation exists in the EU: "A tax whose tax base is a physical unit (or an approximation of a physical unit) of something that has a specific and proven negative impact on the environment". With this definition, the aim of an ecotax is to change behaviour through a price signal, so that it is more favourable to the environment. It is not the use made of the revenue that defines the environmental nature of the tax, but rather its basis.

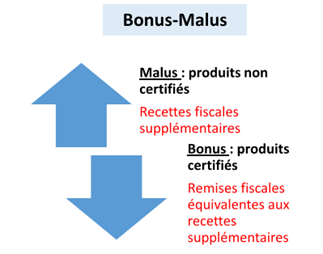

Among the most interesting forms of environmental taxation (ecotaxes), particular attention should be paid to "bonus-malus" type mechanisms, which are attracting growing interest in both the forestry and agricultural sectors. The principle is to tax "non-sustainable" production more heavily (and often increasingly so) in order to be able to grant tax reductions to production deemed to be sustainable, while respecting a principle of budget neutrality (the bonuses being strictly financed by the malus). This principle of budget neutrality is particularly appropriate in the context of the budgetary tensions experienced by many developing countries.

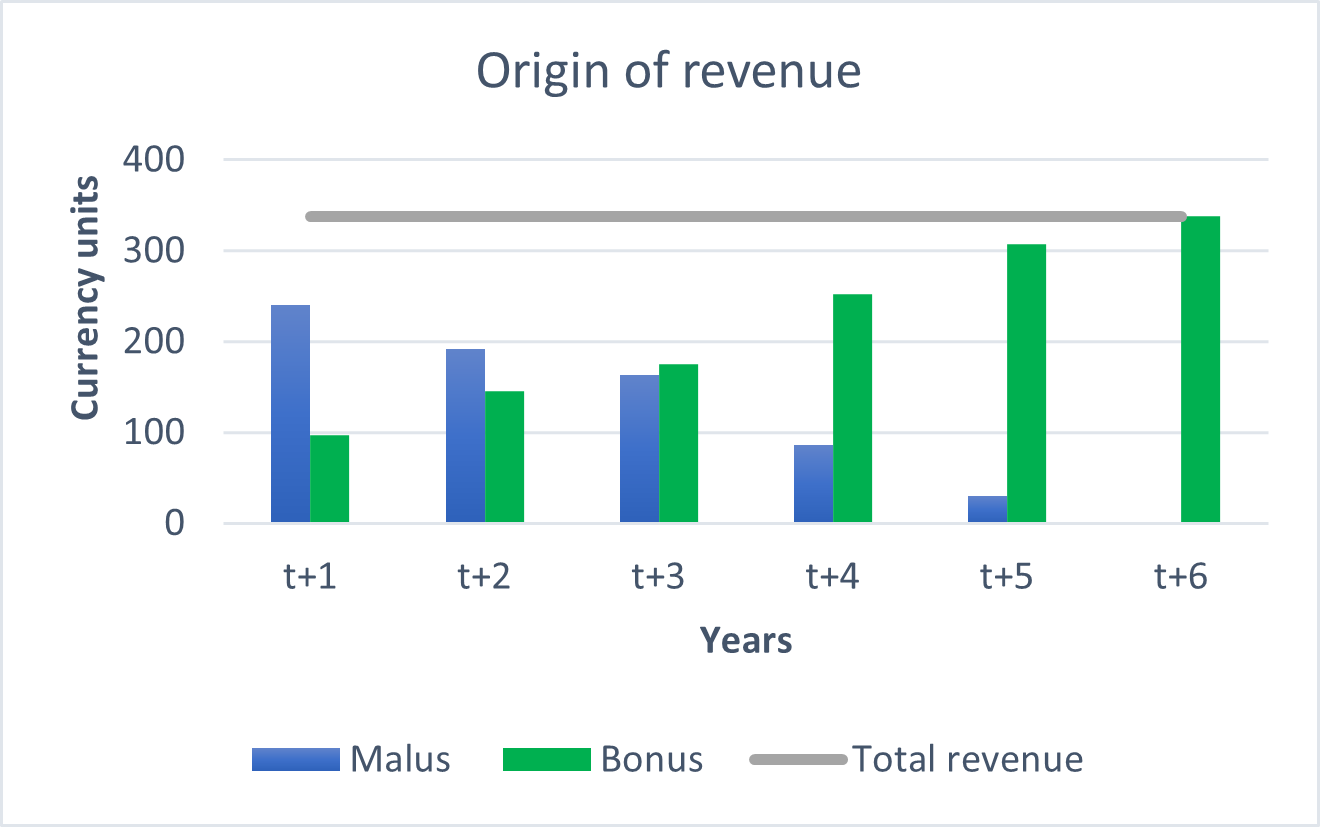

Figure 1. Diagram of a bonus-malus mechanism

In Gabon, a differentiated tax system similar to a bonus-malus mechanism

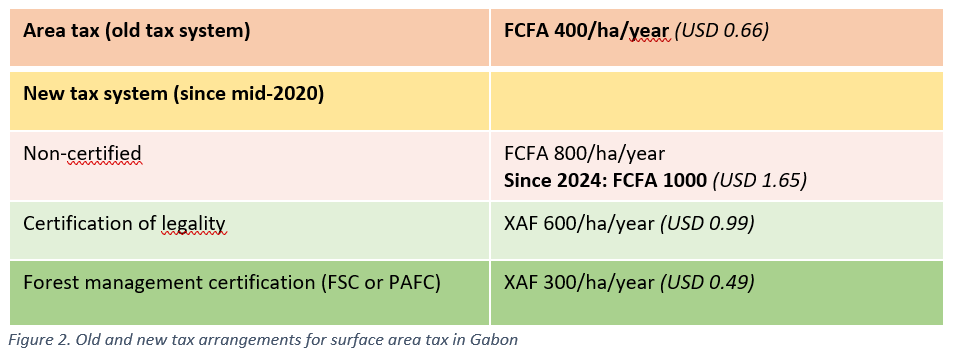

In Gabon, the Amending Finance Law 2020 introduced a differentiated forest tax (three levels) for forest concessions, depending on whether or not they are certified. FSC - or PAFC - certified concessions benefited from a reduction in the area tax (tax increased from 400 to 300 FCFA/ha/year), concessions with legality certification underwent a moderate increase (to 600 FCFA) and non-certified concessions saw their tax double (to 800 FCFA). In 2024, this rate was increased to 1000 FCFA for non-certified concessions. This is not exactly a bonus-malus mechanism, as the objective was not budget neutrality, but the introduction of incentives combined with a desire to increase overall tax revenue.

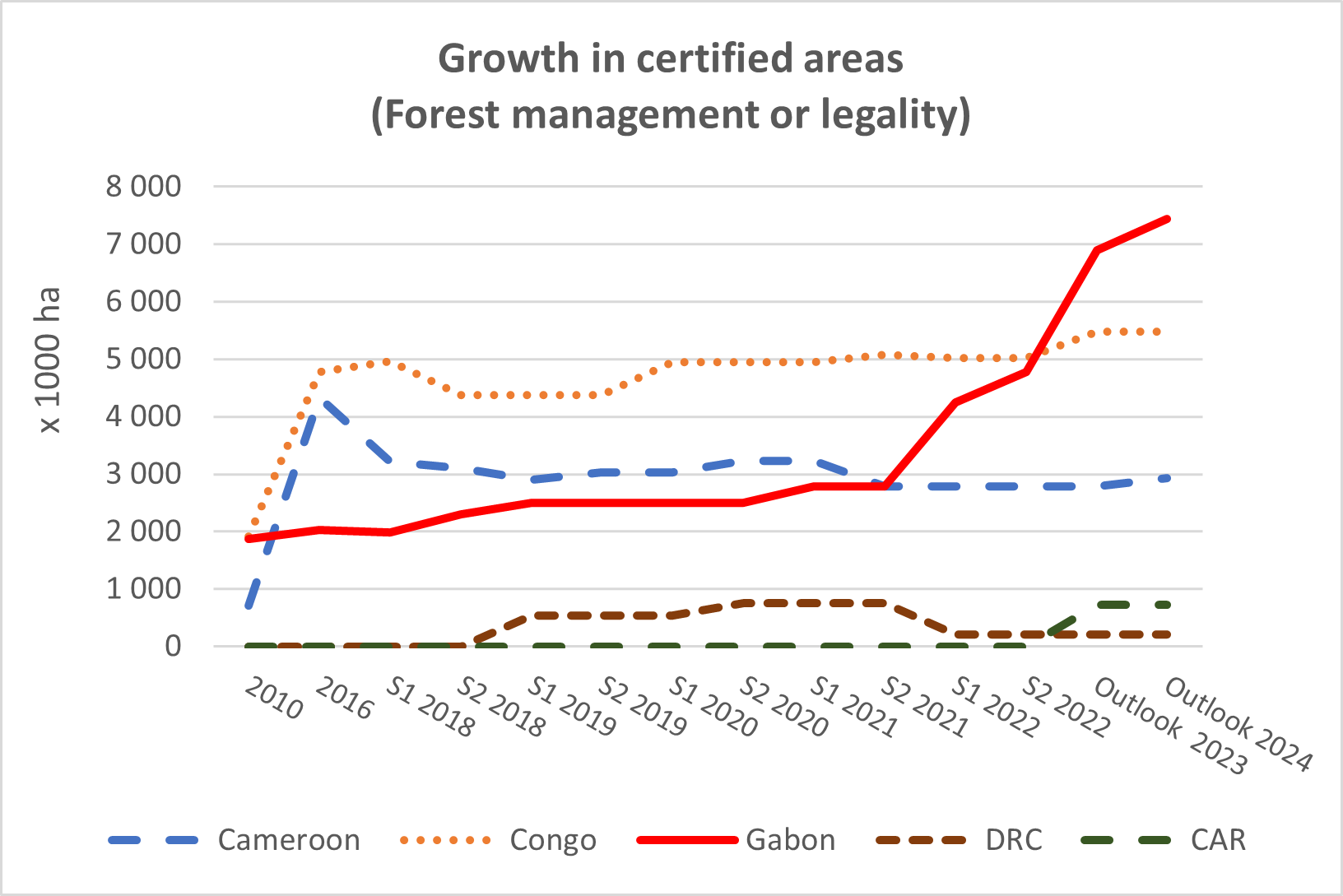

The positive impact, measured in terms of the number of companies embarking on certification, can already be seen in the graph below, which shows a significant increase, in Gabon more than in neighbouring countries, in the number of hectares entering one of the two certification processes.

A single objective: to change behaviour

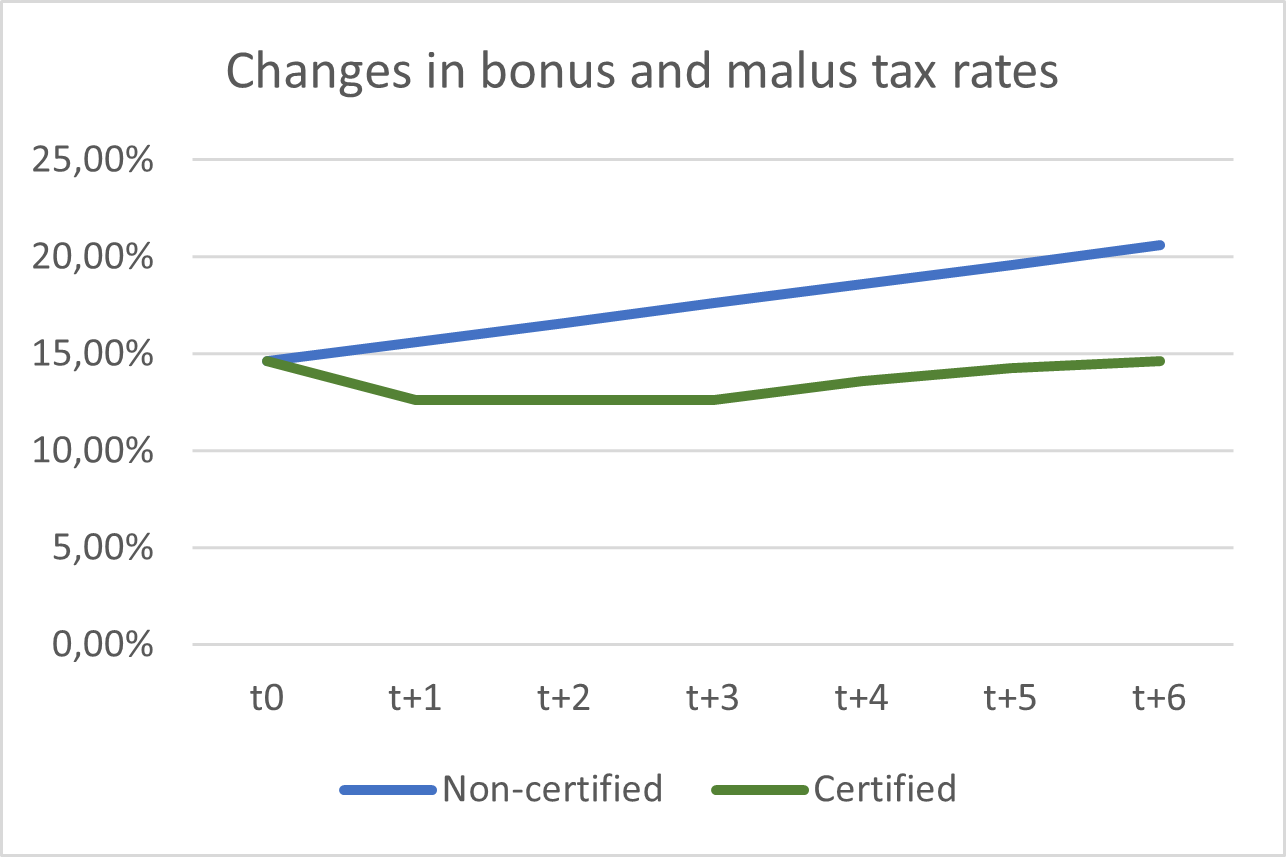

As the sole objective of the bonus-malus mechanism is to change producers' behaviour in favour of sustainability, the bonus-malus mechanism has a dynamic dimension: the bonus (or malus) rates must be revised to respect the principle of budget neutrality, as the greater the proportion of "sustainable" production (giving entitlement to a bonus), the less revenue the malus will generate as a result of the fall in "non-sustainable" production. An Excel simulator has been designed to model and manage this dynamic dimension of the mechanism.

Clarification of the dynamics of the bonus-malus mechanism

At the end of the period, if the incentive has been effective, few or no non-certified units remain, and the bonus rate tends to return to the initial level. What is important, however, is the difference between the respective rates of the malus and the bonus, which tends to increase over time and deters operators who might be tempted to return to non-certified production.

From a budgetary point of view, the source of revenue is gradually shifting from malus to bonuses, with the total remaining stable:

Among the reservations expressed by some national authorities is the fear that certification systems may be too difficult for national operators or small producers to access. One possible solution would be for a small part of the sectoral tax (or a compulsory contribution from all economic operators) to be allocated to a special fund dedicated to the direct remuneration (but capped, to avoid abuse) of auditors. This would alleviate the financial obstacle of the cost of the certification audit for the smallest forestry structures, and would be useful in reducing the auditor's dependence on his client. It remains to convince the governments concerned to introduce such a measure (and for donors to include it in their political dialogue with partner countries).